What is Xero and How Does it Work?

Every business, regardless of who you are or what you do, needs to keep track of their finances. Depending on the size of your company, you may have an entire finance team, or a single person who takes care of everything from payroll to invoices and more.

If you’re looking for a simple, straightforward subscription service to help reconcile debits and credits, keep transactions organized, and help automate other finance tasks, check out Xero.

In this article we’ll go over exactly what Xero is, the pros and cons of using this software, price structures, and features, so you can determine if it’s the right accounting software for you and your business needs.

If you’re already using Xero, you can now try syncing your bills and invoices with Unito!

What is Xero software?

Xero is an accounting subscription-as-a-service (SaaS) cloud-based software based out of New Zealand and is used by companies of all sizes around the world. Their product is geared specifically towards small and medium sized businesses, but depending on a company’s model, can be utilized regardless of size.

With Xero, you’re able to manage all financial aspects of a company. Whether you’re a small business owner or a finance manager at a company, it provides all the tools and integrations needed to keep finances in check.

Xero also provides integrations with more than 1,000 third-party apps and can be used across devices. This makes it extremely easy to use on the go (but we’ll talk more about all the reasons why Xero is amazing in a bit).

What is Xero software used for?

With millions of global subscribers, Xero consistently develops new features and updates existing ones to improve ease of use. Some features are only accessible with higher subscription tiers, but most users can access the following:

- Track bills. You can easily see upcoming bills and dollar amounts owed, schedule future payments, and keep track of billing details in Xero easily.

- Send invoices and accept payments directly from customers. Sending invoices has never been easier! Xero allows you to add a “Click to pay” button which prompts payment via credit card, debit card, or direct debit. Customers can pay how they’d like, and everything is tracked and recorded in one place.

- Manage transaction reconciliations. Xero’s UI makes it easy to track transactions and ensure everything balances across accounts. It also makes “suggested matches” for reconciliation, which saves time going through each individual transaction.

- Store important files and documents. You’re able to easily save copies of bills, share contracts, and record receipts all in one place. Everything is kept secure, organized, and easy to access when needed.

- Create and customize reports. Administrative work is time-consuming, but Xero makes report creation and customization simple and straightforward. Plus, there are options to collaborate with other team members.

- Calculate sales tax. Depending on where you’re located, Xero will calculate local sales tax for you. It’ll also record taxes on each transaction and generate reports for filing taxes.

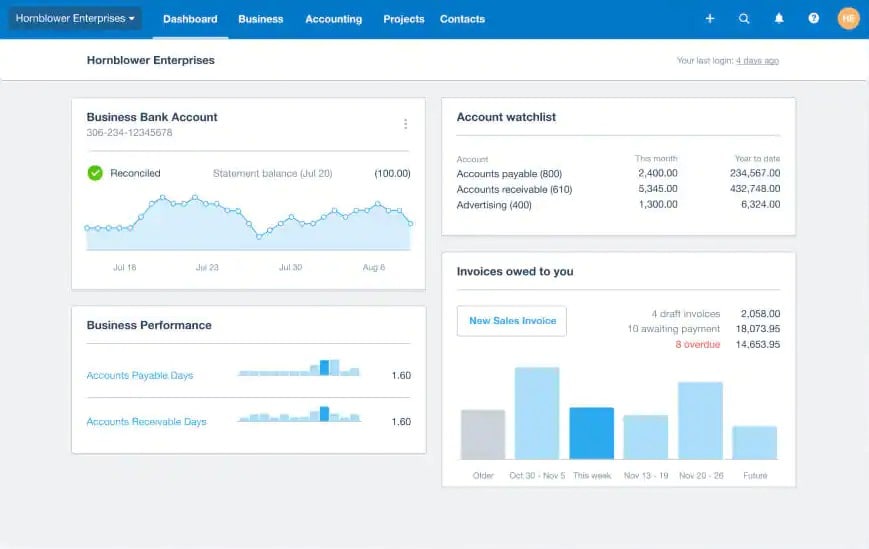

There are even more features for invoicing, generating sales quotes, tracking inventory, and app integration. Xero’s accounting dashboard also gives you a quick glance at daily financial information, so it’s easy to track day-to-day balances and budgets.

Xero truly offers something for everyone with regards to its features, which is why it has become so popular with finance teams and small businesses.

Pros and cons of using Xero

It’s always important to do your research before purchasing a new subscription, so let’s look at the pros and cons of Xero to help determine if it’s right for your needs.

Pros

- You can sign up for a free 30-day trial

- It’s cheaper than many of its competitors

- You can add unlimited users to your account

- There are thousands of third-party app integrations

- There’s a mobile app for on-the-go use

- It has a sleek dashboard and UI for ease of use

- They offer a knowledge base to help troubleshoot issues

- There is certification training available through their corporate website to help train users to understand product offerings better

- It offers a safe and secure platform

- They offer automated monthly billing, and easy cancellation within a one-month notice period

Cons

- There’s no live online support (you have to fill out a form online and wait for them to contact you) and they don’t have a customer service number or email address

- Some users have cited its inventory management is limited in functionality

- Certain features, such as bulk reconciliations and working with multiple currencies, are limited to higher-tired plans

- Additional features, such as claiming expenses, are only available as monthly add-ons and must be paid for on top of your regular subscription fee

How much does Xero cost?

There are currently three different subscription plans that Xero offers:

- Starter: $7.50 a month.

- Growing: $21 a month.

- Established: $39 a month.

Before committing to a subscription plan, you can sign up for a 30-day free trial.

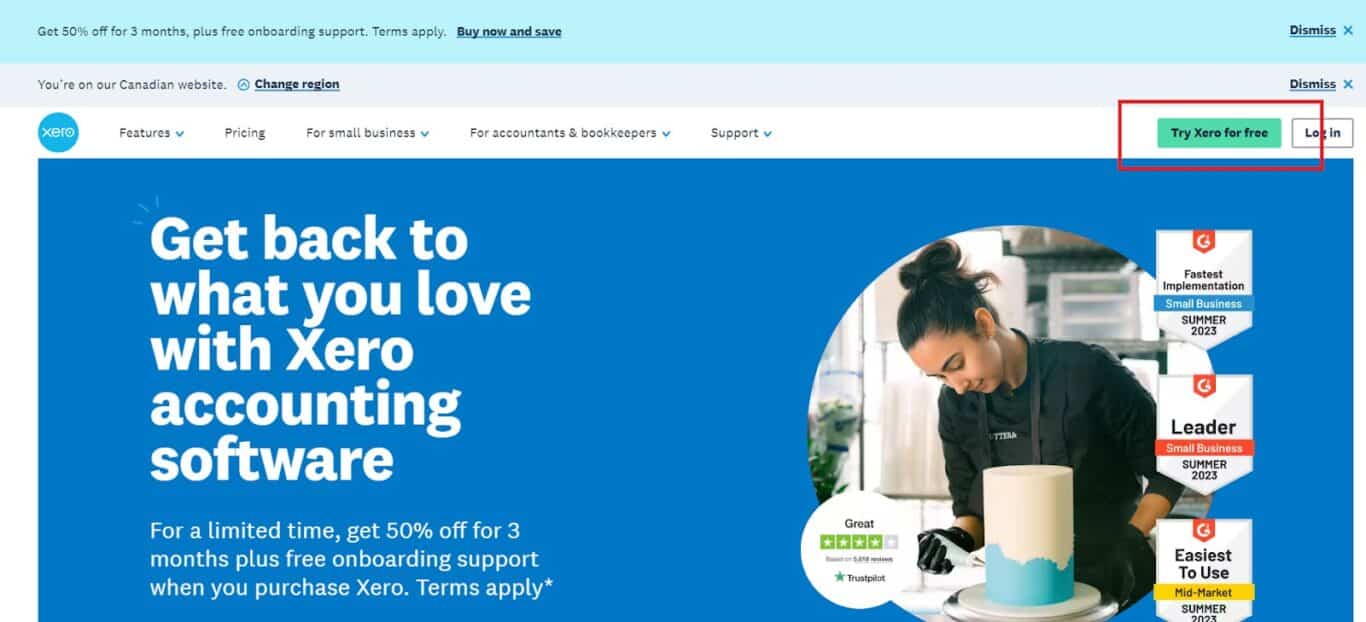

To sign up for a free trial, go to their website and click on the “Try Xero for Free” button on the top right-hand side of the screen.

You’ll be prompted to provide your full name, email address, phone number, and location. After agreeing to their terms and conditions, you can confirm your information and then get started.

You don’t need to provide any credit card or payment information to register for the free trial, so there’s no need to stress over forgetting about it and then being charged for your first month.

At the end of the trial, you will be prompted to select a subscription plan.While the starter plan is an excellent choice for basic financial support, each plan offers additional features and add-ons. Check their website to see what’s included in each tier before making a final selection.

Sync Xero to Google Sheets with Unito

Here’s a quick look at how to sync Xero bills or invoices to Google Sheets with Unito’s integration. It enables automated updates in your spreadsheet as soon as new bills or invoices are added, or any changes are made.

Managing finances has never been easier

Xero is a great option for small businesses and small to medium sized companies. It helps automate financial tasks, keeps transactions organized, and is an affordable option compared to many of its competitors.

And, if you’re already using Unito, you can easily sync bills and invoices! Automation and integration has never been easier.