What Is Stripe and How Does It Work?

If you’ve been doing any kind of business on the internet, you’ve probably heard of Stripe before. It’s one of the most popular ways to process payments for entrepreneurs and businesses. But what is Stripe? How does it work? And what can you expect to pay for this service?

Let’s dive in.

In this article

- What is Stripe?

- How does Stripe work?

- How to set up a Stripe account

- Sync Stripe to Google Sheets

- Stripe FAQ

What is Stripe?

Stripe is a payment processing platform that allows businesses to accept payments from customers through their website, e-commerce platform, app, or pretty much anywhere else on the internet.

With Stripe, developers can easily add payment processing to their apps with just a few lines of code, but it’s not just for technical users. Whether you’re a marketer, an online merchant, an entrepreneur, or just about anyone else, you’ll find that the online platforms you use to run your business often use Stripe as their payment processor of choice. That allows you to accept credit or debit cards for any project.

Already a Stripe user? Here’s a guide on how to sync Stripe data to Google Sheets with Unito.

Stripe is used by Amazon, Shopify, Salesforce, Google, and more.

5 benefits of using Stripe

Without a way to process payments online, your business will struggle to bring in revenue. That means at its simplest, Stripe plugs a very specific hole in your process; allowing customers to pay for what you’re offering. That said, Stripe is far from the only service provider in this category, so here are some benefits that come from using it over anything else.

- Great for online and offline payments: Stripe is used broadly for processing online payments, but that’s not all it’s good for. If you have a physical location, you’ll be able to accept payments through a terminal with the same service you’d use for online payments.

- It’s ubiquitous: Stripe has more than a third of the payment processing market locked down, only a few percent points behind PayPal. It’s a robust tool, and learning how to use it is a useful skill no matter what project you end up working on.

- Simple setup: You can start taking payments from Stripe in just a few steps, often as simple as adding a link to your website. If you need to add payment processing to an app or product, it usually takes just a few lines of code.

- Already integrated: Stripe has a ton of built-in integrations with tools most organizations already use, from Freshbooks to HubSpot and Salesforce. That makes it a lot easier to slot into your existing tool stack.

- More than a payment gateway: While Stripe is best known as a platform for moving money from customers to businesses, it does a lot more than that. It can be used for invoicing, setting up subscriptions, and fraud prevention.

Stripe payments are easy to integrate into your existing workflows and simpler to track and optimize than other platforms.

How does Stripe work?

Stripe essentially works as an intermediary between your customers’ payment methods and your business’s bank account. It’s a flexible platform that supports seamless, no-code integration into whatever website or platform you’re using, but it also gives you the ability to code your own custom point of sale.

How Stripe’s online payment processing works

Stripe allows business owners to accept online payments as easily as if their customers were sitting across the table, cash in hand. That’s because there’s a lot going on behind the scenes you don’t have to worry about. Here’s the basic process most online payments (using credit cards) go through:

- A cardholder visits a merchant’s website and goes through a checkout form, inputting their credit card information.

- A payment gateway sends that information to an acquirer, usually a bank that processes credit card payments through credit card networks.

- Credit card details go on to the bank that issued that credit card for verification before funds are sent back through the card network and acquirer to the merchant.

Trying to set up some way to transfer all that data yourself would take months if not years. Stripe cuts all that work out for you.

Payment methods used with Stripe

Stripe supports over 100 payment methods worldwide, including:

- Credit cards like Mastercard, Visa, and Discover.

- Bank transfers and pre-authorized debits in USD, CAD, and many other currencies.

- Buy now pay later platforms like Affirm and Afterpay.

- Mobile payment services like Apple Pay and Google Pay.

- Online payment platforms like PayPal.

No matter how your customers want to pay for your product or service, you can accept their online payments with Stripe.

How much does Stripe charge?

What you’ll pay to use Stripe’s payment processing platform depends on what you’ll be doing with it. Most users will only have to pay a flat rate per transaction — which varies based on the payment method your customer uses at checkout. Here are some examples of these fees:

- 2.9% + 30¢ for each credit card payment.

- 2.9% + 30¢ for Apple Pay, Google Pay, and similar mobile payment methods.

- 0.8% for ACH debit and ACH credit.

- 5.99% + 30¢ for Afterpay and Affirm payments.

On top of these transaction fees, you can expect to pay some additional fees based on how you’ve integrated Stripe in your payment process. For example:

- 0.4% for post-payment invoices.

- $10 per month for adding payment links to your custom domain.

- 0.25% of account volume for a customized payment platform.

- 0.4% of the total of each invoice generated by Stripe.

You can get a full breakdown of Stripe’s fees here.

How to get started with Stripe

Depending on how you’re using Stripe, you might have already created an account through a website or platform your business is using. But if you haven’t, here’s how you can sign up.

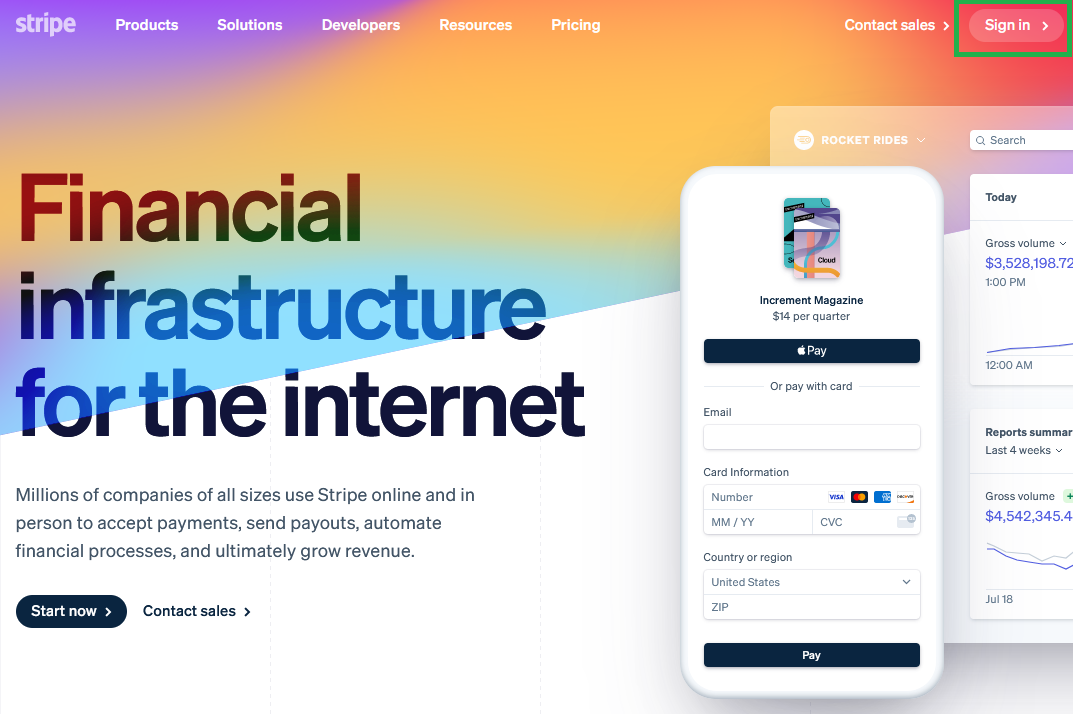

Create an account from Stripe’s homepage

Starting from Stripe’s website, hit Sign in >.

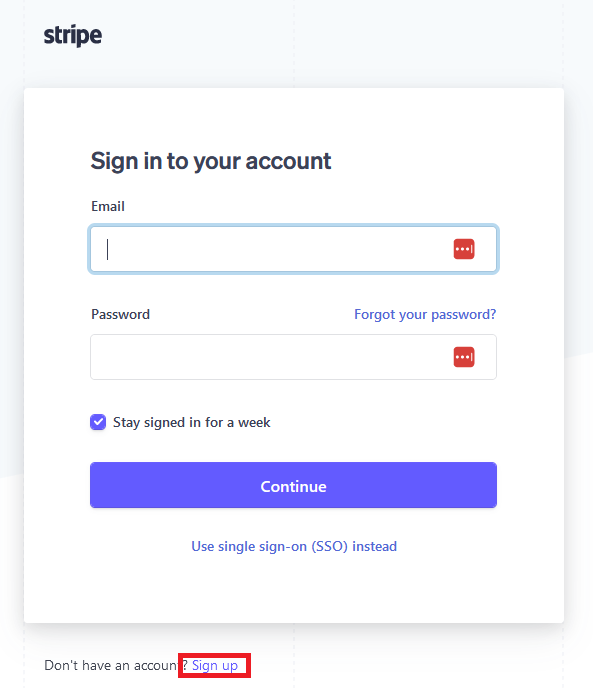

Then, from Stripe’s login page, hit the Sign up link near the bottom.

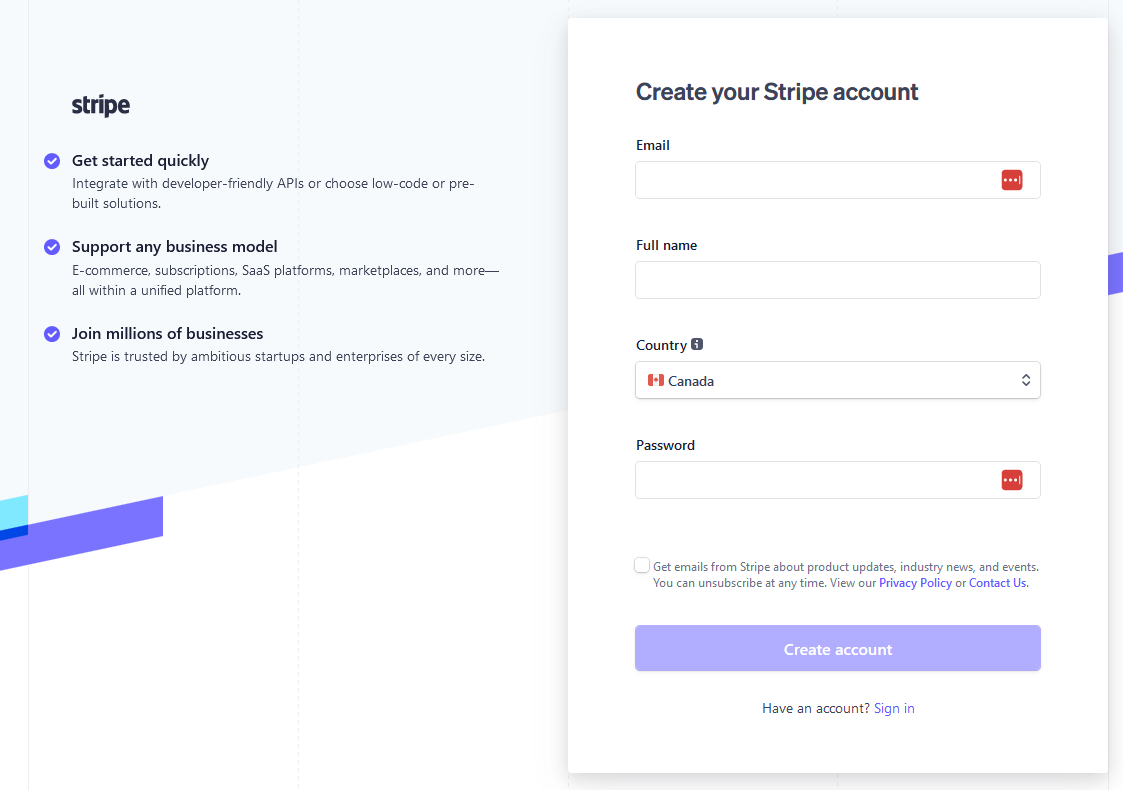

After that, you’ll just need to provide an email, your full name, the country you’re working from, and a password.

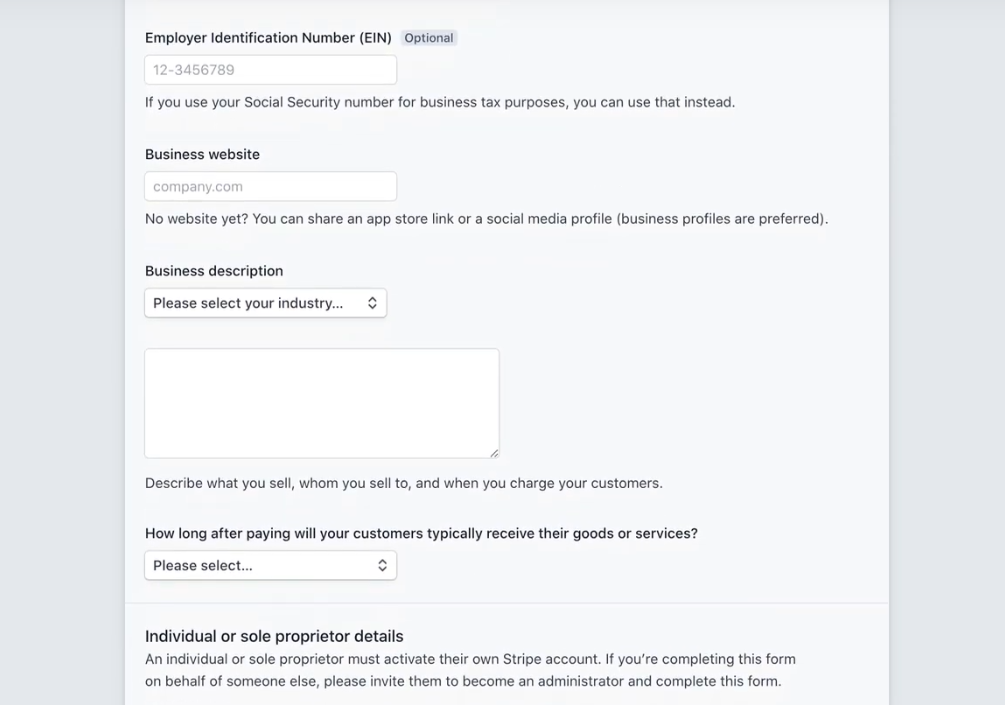

Once you’ve done this, you’ll be asked to provide more details about your business. That includes the kind of legal entity your business is, who runs it, and the kind of business you run.

Before you can accept payments, Stripe will need to verify this information for legal purposes. This usually only takes a few minutes, but you can double-check this process through your Stripe dashboard.

Checking your verification process in Stripe

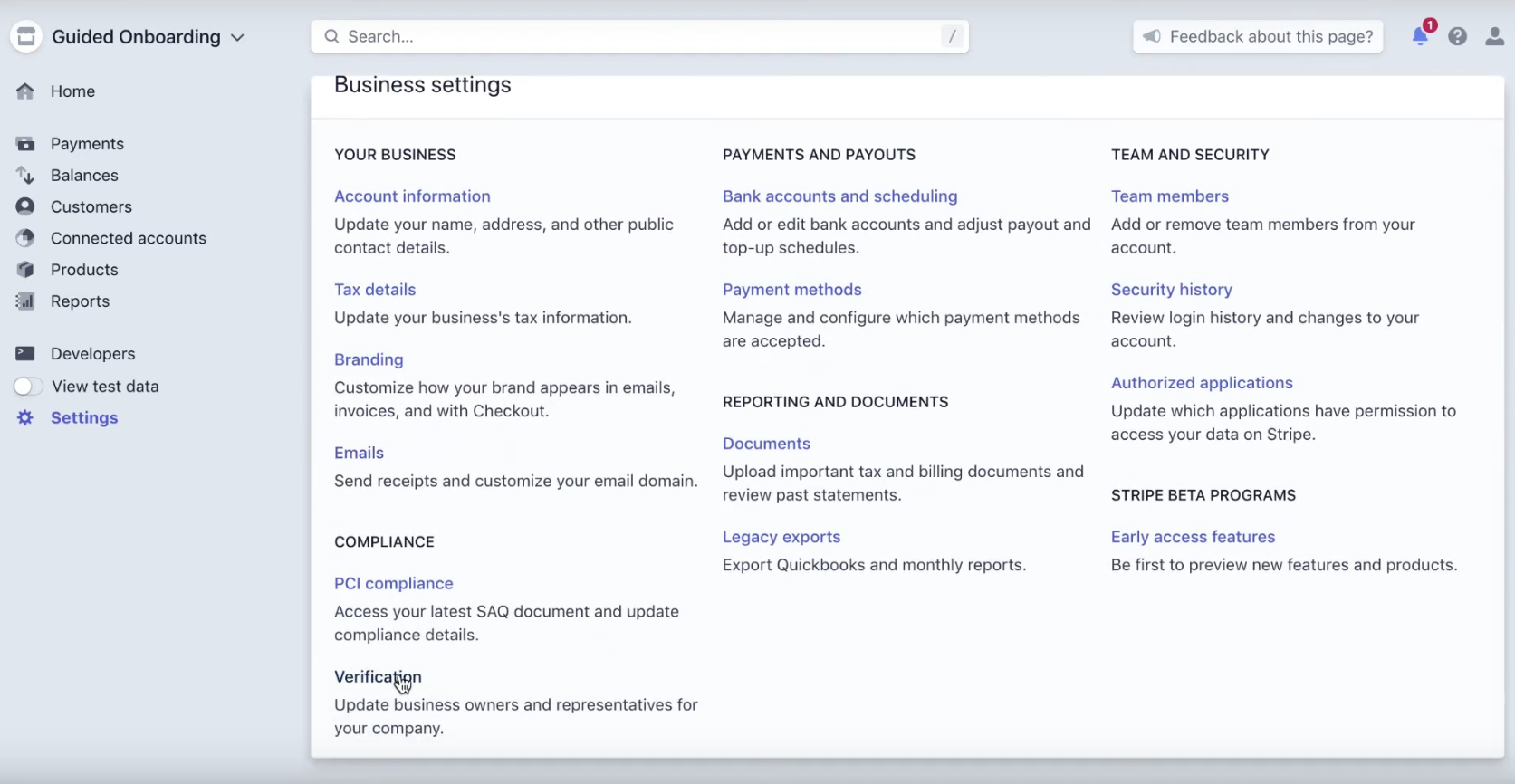

If it’s been more than a few minutes and you’re still not able to use Stripe, you might want to check your account’s verification status. From your Stripe dashboard — which should be the first place you land after signing up — click on Settings, and scroll down until you find the Compliance heading. Then click on Verification.

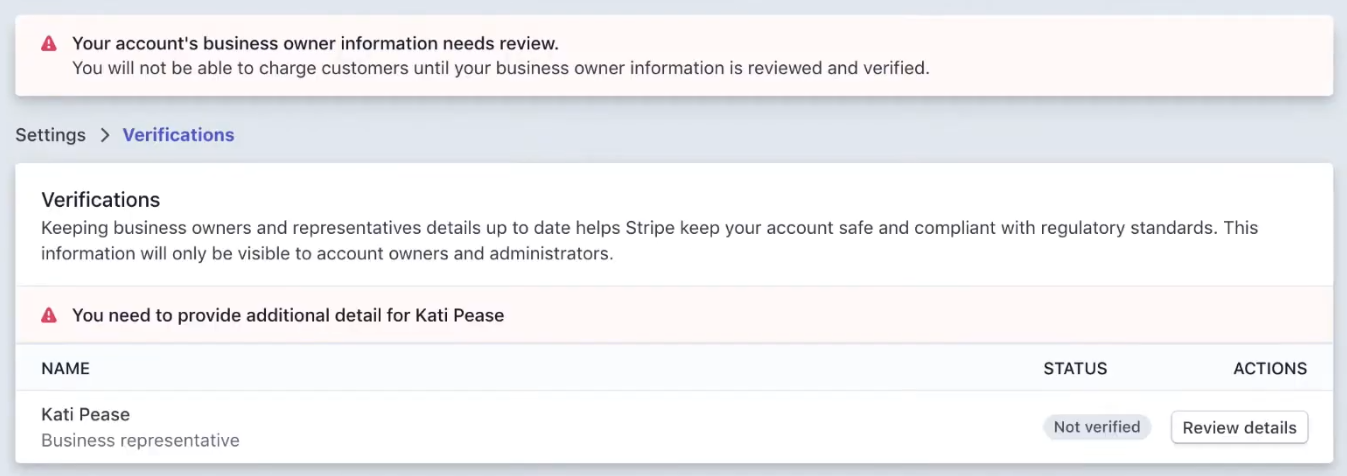

If there are any issues with Stripe’s verifications, you’ll see something like this.

Thankfully, Stripe will guide you through fixing any problems so you can get up and running in no time.

Integrating Stripe with your business

There are four ways you can use Stripe to accept payments from your customers, with varying degrees of technical difficulty.

- No-code: Entrepreneurs and businesses that are high on ambition but low on technical skills can use Stripe’s payment links to receive online payments without any coding skills. You can learn how it’s done with this documentation from Stripe.

- Stripe-hosted: Did you know that you can add a full checkout experience to your website without a ton of development work? Stripe Checkout can support single payments and recurring payments, too.

- With code: If you need a custom solution, Stripe has a ton of documentation for developers who are ready to start building.

- Integrated with other platforms: If you’re using a platform like Shopify to do business, then you’ve probably already used Stripe without realizing it. You might even already have a Stripe account.

Whether you’re a skilled developer or don’t know the difference between Python and an anaconda, you can use Stripe to get paid, no matter what payment method your customers use.

Show your true Stripe

There was a time when accepting any payments over the internet required a ton of code or hefty fees paid out to rigid platforms. But with Stripe, you can offer your customers a smooth checkout process no matter what you’re selling or how big your organization is.

Watch our team sync Stripe to Google Sheets

Try Unito’s stripe integration yourself or watch this demo to see how easy it is to sync financial data to a spreadsheet.